Table of Contents

Changes to Tax calculations

We have made important changes with regards to calculating UK Air Passenger Duty Tax and the German Aviation Tax.

We have divided the tax calculations into 2 stages:

- Stage one - initial calculation based on the number of PAX leaving the country (UK, Northern Ireland or Germany) and the country of destination.

- Stage two - once PAX names are added, the calculation based on actual PAX to their final destination.

In order to receive the figures based on actual PAX, recalculation is required by following these steps:

- add PAX names to relevant flights and delete the quote.

- press 'SAVE & BACK' button.

- edit the request again.

- add new quote calculation.

- save the request with the new quote.

Please see the examples below. For the purpose of the calculations based on the actual PAX, we assume that the PAX added to flights don't change and carry on the following flights.

UK Air Passenger Duty Tax

Example 1 - UK

Calculations based on PAX number

Please see screenshot on the right. The trip consists of 3 flights starts in EGGW and finishes in KJFK. The aircraft is of higher rate type.

In the simplified version of the calculations, we only consider the flights starting in the UK and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

3 x GBP 78 = GBP 234

Explanation:

- rates for the UK based airport of departure.

- airport of arrival for 3 PAX is in Band A (Russian Federation) and higher class aircraft - the rate of GBP 78 per PAX.

Calculation based on actual PAX

Please see screenshot on the right. The trip consists of 3 flights starts in EGGW and finishes in KJFK. The trip starts with 3 PAX and finishes with 2 of the initial PAX on the last flight. 1 PAX finishes at EPWA.

The aircraft is of higher rate type.

In such case the calculation is as follow:

2 x GBP 515 + 1 x GBP 78 = GBP 1108

Explanation:

- rates for the UK based airport of departure.

- airport of arrival for 2 PAX is in Band B (USA) and higher class aircraft - the rate of GBP 515 per PAX.

- airport of arrival for 1 PAX is in Band A (Poland) and higher class aircraft - the rate of GBP 78 per PAX.

- 2 PAX arrived at the destination in Band B and 1 PAX at destination in Band A.

Example 2 - Northern Ireland

Calculations based on PAX number

Please see screenshot on the right. The trip consists of 3 flights starts in EGAA and finishes in KJFK. The aircraft is of higher rate type.

In the simplified version of the calculations, we only consider the flights starting in Northern Ireland and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

2 x GBP 78 = GBP 156

Explanation:

- rates for Northern Ireland based airport of departure.

- airport of arrival for 2 PAX is in Band A (Russian Federation) and higher class aircraft - the rate of GBP 78 per PAX.

Calculation based on actual PAX

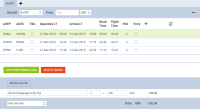

Please see screenshot on the right. The trip consists of 3 flights starts in EGAA and finishes in KJFK. The trip starts with 2 PAX and finishes with 3 PAX on the last 2 flights. The aircraft is of higher rate type.

In such case the calculation is as follow:

2 x GBP 515 = GBP 1030

Explanation:

- rates for Northern Ireland based airport of departure.

- airport of arrival is in Band B (USA) and higher class aircraft - the rate of GBP 515 per PAX for indirect flights.

- 3 PAX arrived at the destination: 2 PAX arrived in Band B country and 1 PAX is not charged for.

—————

German Aviation Tax

Example 1

Calculations based on PAX number

Please see screenshot on the right. The trip consists of 3 flights starts in EDDB and finishes in DNMM. In the simplified version of the calculations, we only consider the flights starting in Germany and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

3 x €7.38 = €22.14

Explanation:

- rates for the Germany based airport of departure.

- airport of arrival for 3 PAX is in Band A (Russian Federation) - the rate of €7.38 per PAX.

Calculation based on actual PAX

Please see screenshot on the right. The trip starts with 3PAX in EDDB. The same PAX continues from UUWW and the trip finishes with 2of the PAX on the last flight. 1 PAX finishes at UUWW.

In such case the calculation is as follow:

2 x €41.49 + 1 x €7.38 = €90.36

Explanation:

- 2 PAX calculated at 'Group C' band (€41.49) because Thailand (VTBS) is the furthest destination from EDDF

- 1 PAX calculated at 'Group A' band (€7.38) because this PAX left the trip in Russian Federation (UUWW)

Example 2

Calculations based on PAX number

Please see screenshot on the right. The trip consists of 3 flights starts in EDDB and finishes in EDDB. In the simplified version of the calculations, we only consider the flights starting in Germany and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

2 x 3 x €7.38 = €44.28

Explanation:

- rates for the Germany based airport of departure.

- there are 2 flights departing from German airports (EDDB and EDDW) with 3 PAX each (6 PAX in total).

- airports of arrival for all 6 PAX are in Band A (Germany and Russian Federation) - the rate of €7.38 per PAX.

Calculation based on actual PAX

Please see screenshot on the right. The trip starts with 3 PAX in EDDB. The same 3 PAX continues from EDDW to UUWW. 1 PAX leaves in UUWW and 2 PAX carry on to EDDB.

In such case the calculation is as follow:

3 x €7.38 = €22.14

Explanation:

- rates for the Germany based airport of departure.

- 3 PAX calculated at 'Group A' band (€7.38) because the same 3 PAX from EDDB carried on from EDDW on the second flight.

Example 3

Please see screenshot on the right. The trip consists of 2 flights starts in EDDB and finishes in VTBS. The trip starts with 0PAX and finishes with 2 PAX on the last flight.

In this case, calculations based on PAX number and actual PAX will be the same.

The TAX calculated will amount to €0, because there are no PAX departing from the German airport.