This is an old revision of the document!

Table of Contents

Taxes

Italian Luxury Tax

This is an additional item available only in the Requests/Quotes section.

'Italian Luxury Tax' is only calculated for the flights from and to Italian airports and depending on the number of PAX on each flight and the distance. The distance is calculated using Great Circle Distance + 95km.

The values are as per below:

- €10 per PAX for the flights shorter than 100km

- €100 per PAX for the flights between 100km and 1500km

- €200 per PAX for the flights longer than 1500km

Example

Trip consists of 3 flights to and from Italy.

Each flight has 3PAX added.

The distance between the airports on 2 of the flights is greater than 1500km and on the 3rd flight - 800km

In such case the calculation is as follow:

(6PAX x €200) + (3PAX x €100) = €1500

UK Air Passenger Duty Tax

UK Air Passenger Duty Tax (UK APD) applies to trips departing from the UK or Northern Ireland and is based on below criteria:

- Destination bands

- Rate types

- Number of PAX

All the rates and allowances of the UK APD can be found here.

The calculations are performed for the whole trip.

1. Destination bands

The rates vary depending on whether the trip starts in the UK or Northern Ireland and the airport of destination.

The trips starting in the Scottish Highlands and Island are excluded from UK APD.

There are 2 destination bands:

- Band ‘A’ where the distance from London/Belfast to the destination country’s capital city is between 0 to 2,000 miles

- Band ‘B’ where the distance from London/Belfast to the destination country’s capital city is between 2,001 miles and 5,500 miles

- Band 'C' where the distance from London/Belfast to the destination country’s capital city is over 5,500 miles

Additionally, the calculation of UK APD for the trips starting at Northern Ireland take into consideration whether the flight is 'direct' or 'indirect'.

The countries falling into each 'Destination band' are listed here

2. Rate types

There are 3 rates of duty for each destination band depending on the class of travel:

- Reduced rate

- Standard rate

- Higher rate

The rate type can be assigned to the aircraft in the Settings > Fleet > Sales tab of the aircraft edit.

3. Number of PAX

Duty is charged on each passenger at the rate for the place where their journey ends (their final destination).

There are 2 stages od UKAPD tax calculations.

The first stage is based on a simplified calculation and only takes into consideration the number of PAX leaving UK and the airport of destination. Based on this data the simplified tax amount is calculated.

Once the PAX names are added, Leon moves on to the second stage of UKAPD tax calculation. Based on the PAX names on each flight, Leon compares the names and calculates the tax based on the actual PAX and their final destination.

The recalculation is required. In order to perform the recalculation, you need to:

- Add PAX names to required flights and delete the quote

- Press the 'SAVE & BACK' button

- Edit the request again

- Add new quote calculation

- Save the request with the new quote

If the journey is made of one flight the final destination is where that flight ends. If the journey includes more than one flight, and the flights are connected, the final destination is where the last flight ends and is not followed by a connected flight.

Example 1 - UK

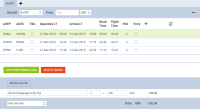

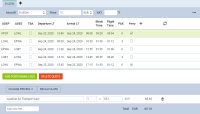

Calculations based on PAX number

See screenshot on the right.

The trip consisting of 3 flights starts in EGGW and finishes in KJFK.

The aircraft is of higher rate type.

In the simplified version of the calculations, we only consider the flights starting in the UK and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

3 x GBP78 = GBP234

Explanation:

- rates for the UK based airport of departure

- airport of arrival for 3PAX is in Band A (Russian Federation) and higher class aircraft - the rate of GBP78 per PAX

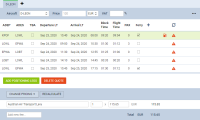

Calculation based on actual PAX

See screenshot on the right.

The trip consisting of 3 flights starts in EGGW and finishes in KJFK.

The trip starts with 3PAX and finishes with 2 of the initial PAX on the last flight. 1PAX finishes at EPWA.

The aircraft is of a higher rate type.

In such case the calculation is as follow:

2 x GBP515 + 1 x GBP78 = GBP1108

Explanation:

- rates for the UK based airport of departure

- airport of arrival for 2PAX is in Band B (USA) and higher class aircraft - the rate of GBP515 per PAX

- airport of arrival for 1PAX is in Band A (Poland) and higher class aircraft - the rate of GBP78 per PAX

- 2PAX arrived at the destination in Band B and 1PAX at destination in Band A

Example 2 - Northern Ireland

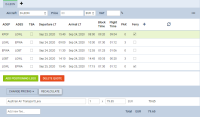

Calculations based on PAX number

See screenshot on the right.

The trip consisting of 3 flights starts in EGAA and finishes in KJFK.

The aircraft is of a higher rate type.

In the simplified version of the calculations, we only consider the flights starting in Northern Ireland and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

2 x GBP78 = GBP156

Explanation:

- rates for Northern Ireland based airport of departure

- airport of arrival for 2PAX is in Band A (Russian Federation) and higher class aircraft - the rate of GBP78 per PAX

Calculation based on actual PAX

See screenshot on the right.

The trip consisting of 3 flights starts in EGAA and finishes in KJFK.

The trip starts with 2PAX and finishes with 3PAX on the last 2 flights.

The aircraft is of a higher rate type.

In such case the calculation is as follow:

2 x GBP515 = GBP1030

Explanation:

- rates for Northern Ireland based airport of departure

- airport of arrival is in Band B (USA) and higher class aircraft - the rate of GBP515 per PAX for indirect flights

- 3PAX arrived at the destination: 2PAX arrived in Band B country and 1PAX is not charged for

German Aviation Tax

German Aviation Tax is a departure tax on commercial air transport.

It is levied on the carriage, from an aerodrome situated in Germany, of passengers on board fixed-wing and rotary-wing aircraft.

The amount due per passenger depends on the distance of the biggest commercial airport in the country of destination from Germany's largest airport, Frankfurt am Main.

Destination bands

The destination airports are divided into 3 bands:

- Group A - listed in Annex 1 as well as the flights within Germany. Domestic flights and flights to countries allocated to the first destination band are taxed at €7.38 per PAX. This will change to €13.03 from April 2020

- Group B - listed in Annex 2. These are countries not listed in Annex 1 and with a distance of not more than 6,000 kilometers including countries in North and Central Africa, the Middle East and Central Asia. A rate of €23.05 applies to PAX flying to countries allocated to the second destination band. This will change to €33.01 from April 2020

- Group C - countries listed in neither Annex 1 nor Annex 2. These charged at €41.49 per PAX. This will change to €59.43 from April 2020

Similar to UK APD TAX, there are 2 stages of GAT calculations.

The first stage is based on a simplified calculation and only takes into consideration the number of PAX leaving Germany and the airport of destination. Based on this data the simplified tax amount is calculated.

Once the PAX names are added, Leon moves on to the second stage of GAT calculation. Based on the PAX names on each flight, Leon compares the names and calculates the tax based on the actual PAX and their final destination.

The recalculation is required. In order to perform the recalculation, you need to:

- Add PAX names to required flights and delete the quote

- Press the 'SAVE & BACK' button

- Edit the request again

- Add new quote calculation

- Save the request with the new quote

More information about the 'German Aviation Tax' can be found here

Example 1

Calculations based on PAX number

See screenshot on the right.

The trip consisting of 3 flights starts in EDDB and finishes in DNMM.

In the simplified version of the calculations, we only consider the flights starting in Germany and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

3 x €7.38 = €22.14

Explanation:

- rates for the Germany based airport of departure

- airport of arrival for 3PAX is in Band A (Russian Federation) - the rate of €7.38 per PAX

Calculation based on actual PAX

See screenshot on the right.

The trip starts with 3PAX in EDDB. The same PAX continues from UUWW and the trip finishes with 2of the PAX on the last flight. 1PAX finishes at UUWW.

In such case the calculation is as follow:

2 x €41.49 + 1 x €7.38 = €90.36

Explanation:

- 2PAX calculated at 'Group C' band (€41.49) because Thailand (VTBS) is the furthest destination from EDDF

- 1PAX calculated at 'Group A' band (€7.38) because this PAX left the trip in Russian Federation (UUWW)

Example 2

Calculations based on PAX number

See screenshot on the right.

The trip consisting of 3 flights starts in EDDB and finishes in EDDB.

In the simplified version of the calculations, we only consider the flights starting in Germany and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

2 x 3 x €7.38 = €44.28

Explanation:

- rates for the Germany based airport of departure

- there are 2 flights departing from German airports (EDDB and EDDW) with 3PAX each (6 PAX in total)

- airports of arrival for all 6PAX are in Band A (Germany and Russian Federation) - the rate of €7.38 per PAX

Calculation based on actual PAX

See screenshot on the right.

The trip starts with 3PAX in EDDB. The same 3PAX continues from EDDW to UUWW. 1PAX leaves in UUWW and 2PAX carry on to EDDB.

In such case the calculation is as follow:

3 x €7.38 = €22.14

Explanation:

- rates for the Germany based airport of departure

- 3PAX calculated at 'Group A' band (€7.38) because the same 3PAX from EDDB carried on from EDDW on the second flight

Example 3

See screenshot on the right.

The trip consisting of 2 flights starts in EDDB and finishes in VTBS.

The trip starts with 0PAX and finishes with 2PAX on the last flight.

In this case, calculations based on PAX number and actual PAX will be the same.

The TAX calculated will amount to €0 because there are no PAX departing from the German airport.

Swedish Aviation Tax

Swedish Aviation Tax is levied on commercial flights carrying passengers and departing from a Swedish airport.

The tax rate depends on the passenger’s final destination. Flights to countries listed under Appendix 1 of the Aviation Tax Act pay 61 SEK per passenger (6 € or $ 7.50). Passengers traveling to countries listed under Appendix 2 are charged 255 SEK (25 € or $ 31.50). For destination countries neither listed in Appendix 1 or 2 of the Aviation Tax Act, the tax rate amounts to 408 SEK per chargeable passenger (40 € or $ 50).

More information about the Swedish Aviation Tax including liability, obligations and the list of the countries included in Appendix 1 and Appendix 2 can be found here

Example 1

Calculations based on PAX number

See screenshot on the right.

The trip consisting of 3 flights starts in EPWA and finishes in HECA.

In the simplified version of the calculations, we only consider the flights starting in Sweden and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

There are 2PAX assigned to the flights from ESGG and 1PAX assigned to a flight from ESSA.

The calculation is as follow:

2 x SEK122 + 1 x SEK255 = SEK377

Explanation:

- rates for the Sweden based airport of departure

- 2PAX departing from ESGG to ESSA - band 1 (2 x SEK122)

- 1PAX departing from ESSA to HECA - band 2 (1 x SEK255)

Calculation based on actual PAX

See screenshot on the right.

The trip starts with 1PAX in EPWA. For the tax calculations, 2PAX are assigned from the Swedish airport (ESGG) but only one of them reaches the final destination located in band 2.

In such case the calculation is as follow:

1 x SEK255 = SEK255

Explanation:

- 1PAX starting at EPWA is not included in the calculation due to being considered as a transfer PAX (PAX that arrives to Sweden from a different country and continues on the journey)

- 1PAX joining at ESGG and departing the journey at HECA. This is band 2 charged at SEK255

Austrian Air Transport Levy

Austrian Air Transport Levy (ATL) is a departure tax charged on the carriage, from Austrian airports, of passengers on board aircraft with an authorized weight of more than 2,000 Kg (4,400 lbs).

Both commercial and non-commercial business aircraft operators are subject to this tax.

The amount due per passenger depends on the geographical distance of the destination country/territory from Austria.

Starting from 1 September 2020, passengers will be taxed the following rates:

- 30 € (GCD < 350km)

- 12 € (GCD > 350km)

If you carry out domestic flights in Austria and are liable to pay VAT for the transport of passengers, the effective tax rate will be slightly lower because VAT can be deducted from the air transport levy.

Under this scenario, the tax rates per passenger are:

- 26.55 € (GCD < 350km)

- 10.62 € (GCD > 350km)

There are also the following exemptions from the ATL due:

- children below the age of two

- animals

- crewmembers and maintenance personnel

- training flights

- departures following tech stops and unscheduled landings up to 24h. Departures after 24h are subject to ATL calculations

More information about the Austrian Air Tax Levy can be found here

Examples

Calculations based on PAX number

See screenshot on the right.

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

In the simplified version of the calculations, we only consider the flights starting in the UK and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

3 x €12 + 3 x €26.55 = €115.65

Explanation:

- MTOW of an aircraft is more than 2000kg

- 3 PAX are flying internationally and the GCD is more than 350NM (GCD) - 3 x €12

- 3 PAX are flying domestically and the distance is less than 350NM (GCD) - 3 x €26,55

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations

Calculations based on actual PAX

See screenshot on the right.

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

PAX names are assigned to the flights.

The calculation is as follow:

3 x €26.55 = €79.65

Explanation:

- MTOW of an aircraft is more than 2000kg

- the same PAX are assigned on both flights and the tax is calculated on the higher rate (domestic) - 3 x €26.55

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations

Calculations based on actual PAX and 24h gap

See screenshot on the right.

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

The calculation is as follow:

3 x €12 + 3 x €26.55 = €115.65

Explanation:

- MTOW of an aircraft is more than 2000kg

- 3 PAX are flying internationally and the GCD is more than 350NM (GCD) - 3 x €12

- 3 PAX are flying domestically and the distance is less than 350NM (GCD) but also there is an over 24h gap between EPWA-LOBT and LOBT-LOWL. This is the reason why PAX on LOBT-LOWL are subject to taxation - 3 x €26,55

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations

Calculations based on actual PAX including Animal

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

PAX names are assigned to the flights. Domestic flight with an animal and 2PAX.

The calculation is as follow:

1 x €12 + 2 x €26.55 = €65.10

Explanation:

- MTOW of an aircraft is more than 2000kg

- 2 PAX and 1 animal are flying domestically and the distance is less than 350NM (GCD) - 2 x €26,55

- 3 PAX are flying internationally, where 2 of the PAX are flying on the domestic flight and 1 PAX is not. The 1 PAX is included in the calculations and GCD is more than 350NM (GCD) - 1 x €12

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations