This is an old revision of the document!

New features in RQ panel

We have added the following features to Requests/Quotes section:

- Austrian Air Transport Levy (Tax) calculations

Austrian Air Transport Levy

Austrian Air Transport Levy (ATL) is a departure tax charged on the carriage, from one of the six major Austrian airports: Vienna, Salzburg, Linz, Innsbruck, Klagenfurt, Graz), of passengers on board aircraft with an authorized weight of more than 2,000 Kg (4,400 lbs).

Both commercial and non-commercial business aircraft operators are subject to this tax.

The amount due per passenger depends on the geographical distance of the destination country/territory from Austria.

Starting from 1 September 2020, passengers will be taxed the following rates:

- 30 € (GCD < 350km)

- 12 € (GCD > 350km)

If you carry out domestic flights in Austria and are liable to pay VAT for the transport of passengers, the effective tax rate will be slightly lower because VAT can be deducted from air transport levy.

Under this scenario, the tax rates per passenger are:

- 26.55 € (GCD < 350km)

- 10.62 € (GCD > 350km)

There are also the following exemptions from the ATL due:

- children below the age of two

- animals

- crewmembers and maintenance personnel

- training flights

- departures following tech stops and unscheduled landings up to 24h. Departures after 24h are subject to ATL calculations

More information about Austrian Air Tax Levy can be found here

Examples

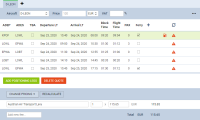

Calculations based on PAX number

Please see screenshot on the right.

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

In the simplified version of the calculations, we only consider the flights starting in the UK and looking at the destination band and the number of PAX flying. No actual PAX are assigned.

The calculation is as follow:

3 x €12 + 3 x €26.55 = €115.65

Explanation:

- MTOW of an aircraft is more than 2000kg

- 3 PAX are flying internationally and the GCD is more than 350NM (GCD) - 3 x €12

- 3 PAX are flying domestically and the distance is less than 350NM (GCD) - 3 x €26,55

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations

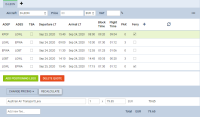

Calculations based on actual PAX

Please see screenshot on the right.

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

PAX names are assigned to the flights.

The calculation is as follow:

3 x €26.55 = €79.65

Explanation:

- MTOW of an aircraft is more than 2000kg

- the same PAX are assigned on both flights and the tax is calculated on the higher rate (domestic) - 3 x €26.55

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations

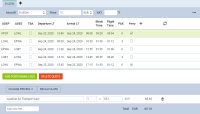

Calculations based on actual PAX and 24h gap

Please see screenshot on the right.

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

The calculation is as follow:

3 x €12 + 3 x €26.55 = €115.65

Explanation:

- MTOW of an aircraft is more than 2000kg

- 3 PAX are flying internationally and the GCD is more than 350NM (GCD) - 3 x €12

- 3 PAX are flying domestically and the distance is less than 350NM (GCD) but also there is over 24h gap between EPWA-LOBT and LOBT-LOWL. This is the reason why PAX on LOBT-LOWL are subject to taxation - 3 x €26,55

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations

Calculations based on actual PAX including Animal

The MTOW of the aircraft is more than 2000kg (4400lbs).

The trip consists of 5 flights, 3 of which start in Austria.

PAX names are assigned to the flights. Domestic flight with an animal and 2PAX.

The calculation is as follow:

1 x €12 + 2 x €26.55 = €65.10

Explanation:

- MTOW of an aircraft is more than 2000kg

- 2 PAX and 1 animal are flying domestically and the distance is less than 350NM (GCD) - 2 x €26,55

- 3 PAX are flying internationally, where 2 of the PAX are flying on the domestic flight and 1 PAX is not. The 1 PAX is included in the calculations and GCD is more than 350NM (GCD) - 1 x €12

- Flight from LOWL to EPWA is a positioning leg (FERRY) therefore not included in the calculations