Mineral Oil Tax

Together with Country Tax rates, Leon now also allows uploading Mineral Oil Tax rates.

The rates are loaded in the standard way, just like tax rates, by uploading a file in the appropriate format ine the OPS > 'Fuel prices' section.

It is important that the tab within the file containing the rates is named MOT and VAT.

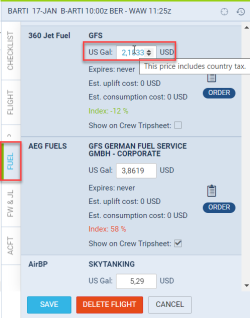

Once the file is uploaded, the Tax, MOT, and VAT rates will appear in the Country tax rate column when hovering the mouse over the ? icon.

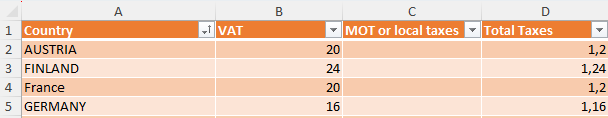

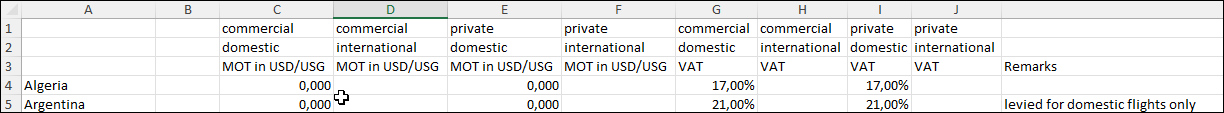

The correct file formats that can be uploaded are presented below:

- File format that contains the 'Total Tax' information only

- New file format that includes tax rates based on the type of operations

After uploading the file, the fuel prices in the tab 'FUEL' in OPS are being recalculated accordingly:

- If the Fuel File contains the Total price value, then this price is prioritized and the values from the 'MOT' and 'VAT' columns are omitted

- If the 'Total price' column is not included or empty:

- Total Fuel Price = (Base + MOT) x (1 + VAT)

- Base Fuel Price = (Total Fuel Price / (1 + VAT)) - MOT

The MOT rate is fixed at USD/GAL, therefore it is converted to the units configured for an operator or an aircraft.

Leon also differentiates the costs of both commercial and non-commercial flights are taken into account.